With the easing of lockdown businesses are coming to terms with the ‘new normal’ and the impact it’s having on R&D, innovation and cashflow.

The UK and Scottish governments are doing what they can to mitigate the economic impact of the pandemic. That’s why Rishi Sunak, and Fiona Hyslop are emphasising the importance of innovation and R&D to fire up the economy.

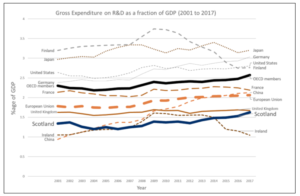

As you will see, from the graph below, Scotland’s overall expenditure on R&D as a percentage of GDP is low relative to comparator countries. This indicates Scottish firms are still not maximising their potential from R&D.

Source OECD: Scottish Government

The UK Government has made clear it’s on a mission to make the UK an innovation hub. It’s essential we ensure Scottish businesses are securing maximum benefit when carrying out research and development and recognise it as innovative.

Remember, the Government is rewarding innovation. It has recognised R&D tax credits are an effective way to deliver the reward straight back into your business. You may not know this, but the R & D tax credit (RDTC) scheme is in its twentieth year – yet 80% of businesses are missing out.

The Government reaffirmed its support for RDTC by allocating extra manpower increasing resources at HMRC to process claims more efficiently.

Now HMRC is processing most claims within 28 days. We know this is true as our clients have received money in their bank within the 28 days. This has been a welcome boost to their cashflow during uncertain times.

What does innovation look like?

You don’t need to wear a lab coat or be carrying out ground – breaking medical research to be innovative. You’d be surprised to learn the improvements you make to systems, products and processes could be eligible for R&D tax credits.

What next

To discover more resources visit R&D tax credits or book a 15 minute chat to discuss R&D tax credits and give your business the cash boost it deserves.